trust capital gains tax rate australia

The income tax rates on income earned from assets in a testamentary trust are the same as personal income tax rates. Namely the 50 CGT discount.

Understanding The Different Trusts In Australia Understanding Blog Header Trust

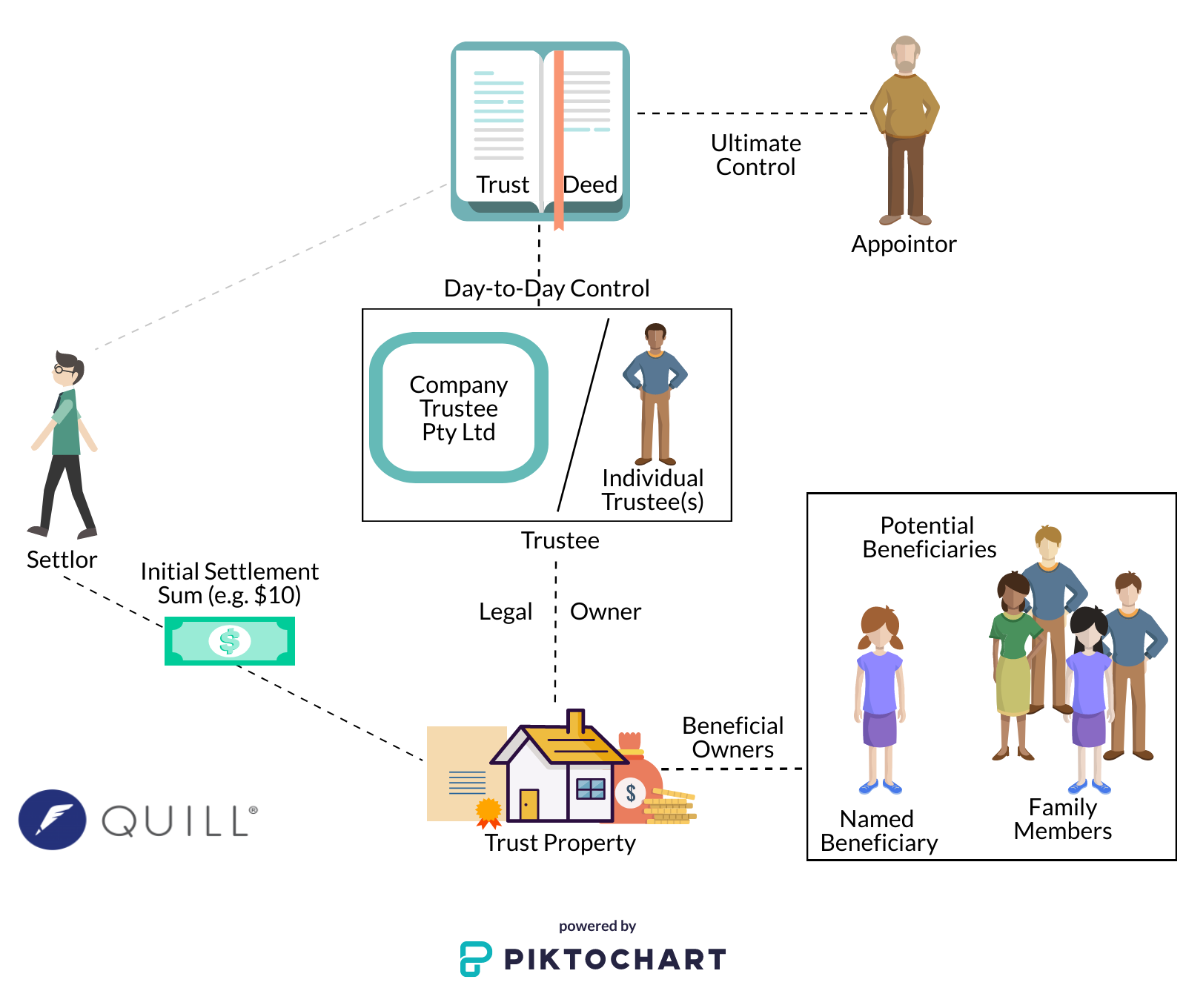

Advice on who the beneficiaries should be.

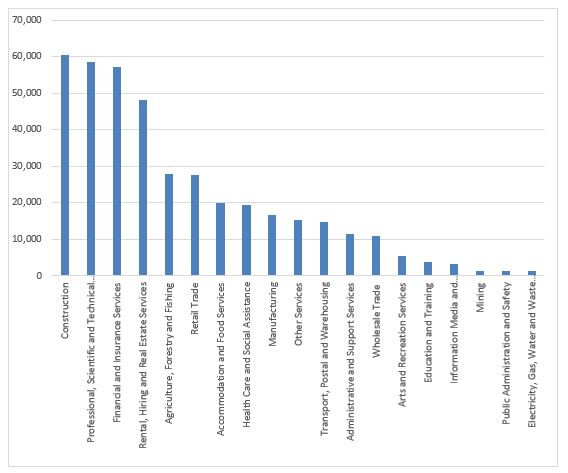

. Irrespective of who pays the tax be it the beneficiaries per s97 or s98A or the trustee per s98 income tax is assessed based on the trusts net income. Ss982A 983 on the net income of the trust attributable to Australian sources If the beneficiary is a trustee of another trust which has a non-resident trustee. At basically 13000 in income they hit the highest tax rate.

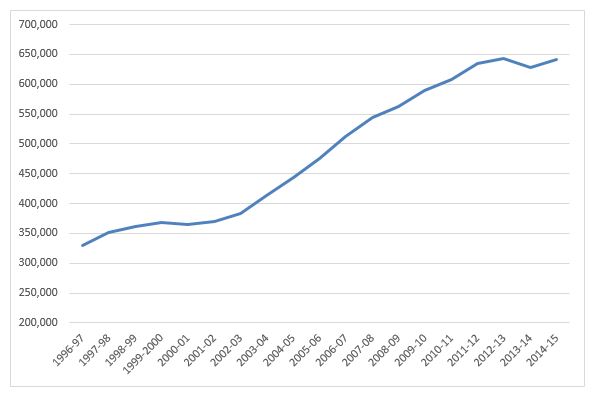

S984 then the trust pays tax on the beneficiarys share at 45 47 for the next 3. The trust may be eligible for the 50 CGT discount if you hold the asset in the trust for 12 months or more. If the trust disposes of all assets it is generally subject to capital gains tax CGT.

However once the general 50 discount is deducted the taxpayer only declares 5000 capital gains income the tax on which at 37 is 1850. However if the asset is owned by a company the company is not entitled to any capital gains tax discount and youll pay 30 tax on any net capital gains. The effective tax rate on the capital gain of 10000 is 185.

If a trustee is assessed in respect of a non-resident. In certain circumstances it may also be possible to distribute the trusts capital gains to beneficiaries to avoid the higher rates of capital gains that usually apply to trusts as well as the net capital gains tax of 38. Registration of its tax file number with the ATO.

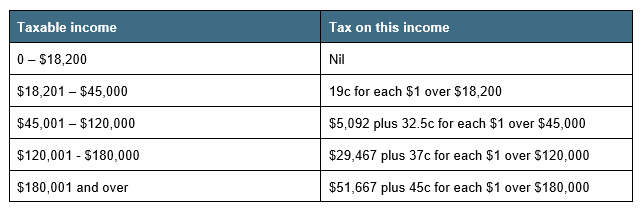

For example income distributed to beneficiaries under 18 could be taxed up to 66. The marginal tax rates for individuals. Taxation of Capital Gains.

A capital gain of 200 that is eligible for the CGT 50 discount. The Guide to capital gains tax 2021 explains how capital gains tax CGT works and will help you calculate your net capital gain or net capital loss for 202021 so you can meet your CGT obligations. The Income Tax Assessment Act 1936 ITAA 1936 ensures that a trustee is assessed on a non-resident trustee beneficiarys share of the net income of a trust.

If you require further assistance with respect to the above or would like to know more about taxation you are welcome to contact our team of experienced tax accountants and tax lawyers by clicking here to submit an online enquiry form or call us on 1300 QUINNS 1300 784 667 or on 61 2 9223 9166 to arrange conference or appointment. Advice on who should be nominated as the trustee appointor and settlor. This means you pay tax on only half the net capital gain on that asset.

There is a capital gains tax CGT discount of 50 for Australian individuals who own an asset for 12 months or more. Will Wizard Australia Pty Ltd. Passing on 50 CGT discount.

Somebody will pay tax on the net income of a trust. And for SMSF the tax rate is 15 and the discount is 333 rather than 50 for individuals. Some assets are exempt from CGT such as your home.

The tax on the capital gain would be 37. When setting up a family trust you can expect to pay between 1500 and 2500 GST. Set up costs for a family trust.

And that net income is determined as if the trustee. As an example the most common CGT. Although irrevocable trusts are complex trusts which means they can accumulate income they make on trust assets the trustees normally reduce taxes by distributing all the trust income each year.

Irrevocable trusts have a major tax issue. In most cases even though a CGT Event occurs you can disregard a capital gain or capital loss on an asset if the asset was acquired before 20 September 1985 known as a pre CGT asset. What is the capital gains tax rate on a trust.

Accordingly when the beneficiary prepares their tax return they must include any trust distributions as part of their income. Click here for tax rates for 2010 2011 and 2012 for both Australian residents and non-residents. One of the tax advantages of a family trust is related to Capital Gains Tax CGT.

To calculate a capital gain or loss you have to determine if a CGT event has happened. Surry Hills NSW 2010. Capital Gain Tax Rate.

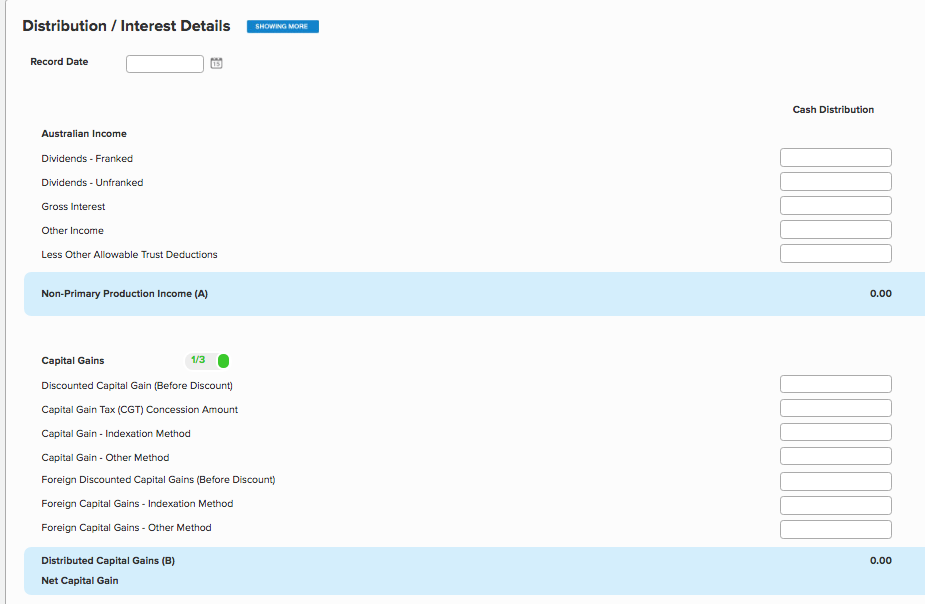

Level 223 Foster Street. A capital gain or a capital loss will arise where a capital gains tax CGT event occurs or if another trust distributes a capital gain to you. Creation of the trust deed.

As part of the trusts net income or net loss the trust has to take into account any capital gain or loss. This treatment is similar to the way in which trustees are assessed in relation to a non-resident company or individual beneficiary. Companies with a turnover less than 5000000000.

A trustee derived the following amounts in the 201415 income year. However if the trust distributes the discounted capital gain to its beneficiaries or unit holders in the case of a unit trust the beneficiaries are. There is tax planning flexibility available through a trust because you can distribute income to beneficiaries.

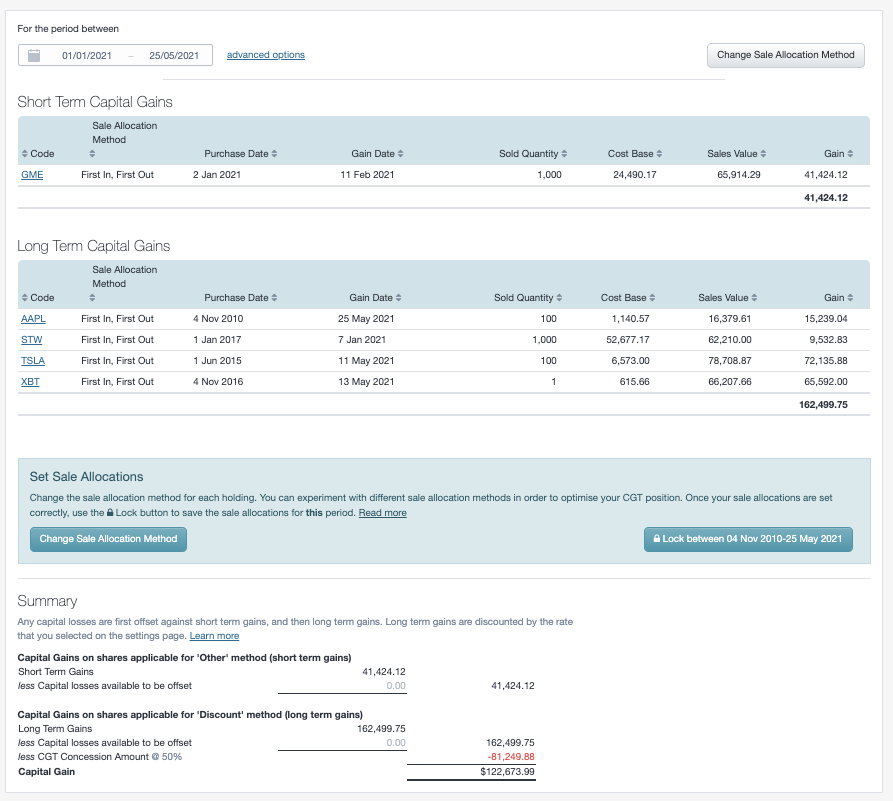

Capital Gains Tax CGT is the tax you pay on capital gains that arise from the disposal of shares. A flat rate of 30 for corporate beneficiaries. Investments of less than 30 of the equity in an ESIC would generally qualify for a 20 non-refundable tax offset capped at AU200000 per investor including any offsets carried forward from the prior years investment and a 10-year tax exemption on any capital gains arising on disposal of the investment.

Companies with a turnover greater than 5000000000. Australia Corporation Capital Gains Tax Tables in 2022. The amount of tax you need to pay will therefore depend on the tax rates applicable to the relevant beneficiary such as an individual or a company.

The trust deed defines income to include capital gains. At the beneficiarys tax rates. The taxation rate on these distributions is.

Including a 10000 capital gain in income would cost 3700. There are links to worksheets in this guide to help you do this. The income of the trust estate is therefore 300 100 interest income 200 capital gain and the net income of the trust is 200 100 interest income.

Unlike a company which is not eligible for any capital gains tax CGT discount a trust is eligible for the 50 CGT discount provided that the trust has held the property for at least 12 months before it is sold. S97 98A 98that share of the net income of the trust estate. This guide is not available in print or as a downloadable PDF Portable Document.

Broadly you calculate CGT on the difference between the asset sale price and the price paid for its acquisition.

Health And Social Problems Are Worse In More Unequal Countries The Spirit Level Wilkinson Pickett Penguin 2009 Social Problem Math Literacy Social Class

Ending Tax Avoidance Evasion And Money Laundering Through Private Trusts Acoss

How To Enter A Distribution Tax Statement Simple Fund 360 Knowledge Centre

Indirect Taxes In India Google Search Indirect Tax Math Tax

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Find The Best Wills And Estate Planning Lawyer In Ca Estate Planning How To Plan Lawyer

Tax Depreciation Schedules Australia Gives Totally New Financial Year Under Taxation Figures Of Property Valuation Being A Landlord Property Investor Investing

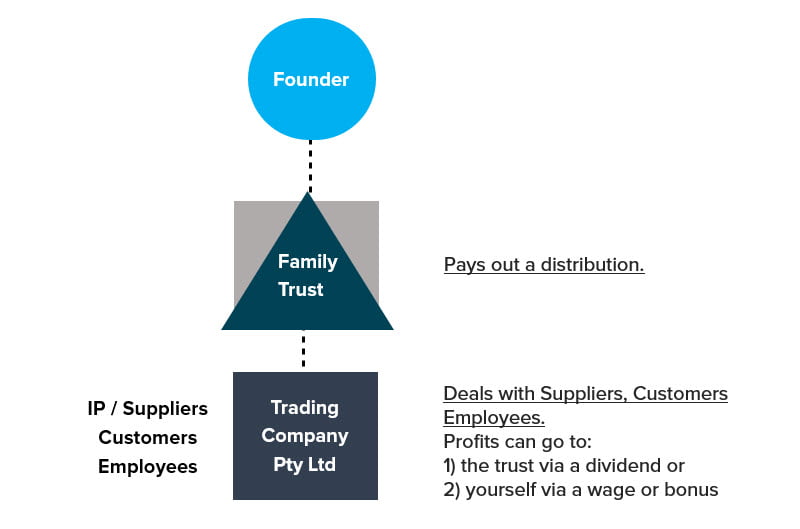

How To Set Up A Family Trust Quill Group Tax Accountants Gold Coast

Ending Tax Avoidance Evasion And Money Laundering Through Private Trusts Acoss

Australia Crypto Tax Guide 2022 Koinly

In Gold We Trust Why Bullion Is Still A Safe Haven In Times Of Crisis Gold Bullion Gold Money Buying Gold

Including A Family Trust In Your Business Structure Fullstack Advisory

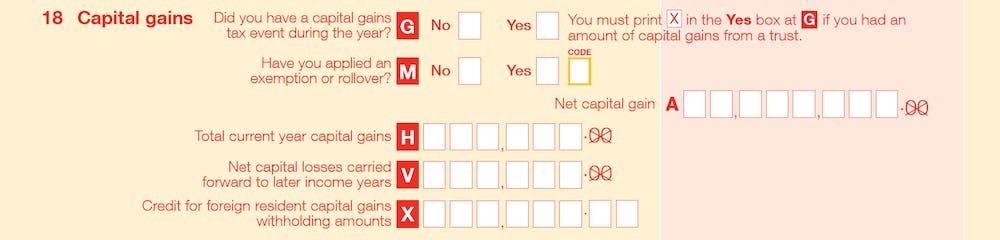

End Of Financial Year Guide 2021 Lexology

How Is A Family Trust Taxed In Australia Liston Newton Advisory

Matthew Ledvina Offers Us Tax Structuring Strategy Tax Return Us Tax Tax

How Is A Family Trust Taxed In Australia Liston Newton Advisory

Capital Gains Tax Cgt Calculator For Australian Investors Sharesight

Capital Gains Tax Cgt Calculator For Australian Investors Sharesight

Capital Gains Tax On Shares In Australia Explained Sharesight